Academic Papers

Lynne G. Zucker, Michael R. Darby. Socio-economic Impact of Nanoscale Science: Initial Results and NanoBank NBER Working Paper No. 11181, March 2005.

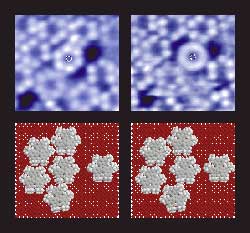

Institute of Nanotechnology: Image of a Molecular Wheel |

Michael R. Darby, Lynne G. Zucker. Grilichesian Breakthroughs: Inventions of Methods of Inventing and Firm Entry in Nanotechnology NBER Working Paper No. 9825, July 2003.

Metamorphic progress (productivity growth much faster than average) is often driven by Grilichesian inventions of methods of inventing. For hybrid seed corn, the enabling invention was double-cross hybridization yielding highly productive seed corn that was not self-propagating. Biotechnology stemmed from recombinant DNA. Scanning probe microscopy is a key enabling discovery for nanotechnology. Nanotech publishing and patenting has grown phenomenally. Over half of nanotech authors are in the U.S. and 58 percent of those are in ten metropolitan areas. Like biotechnology, we find that firms enter nanotechnology where and when scientists are publishing breakthrough academic articles. A high average education level is also important, but the past level of venture-capital activity in a region is not. Breakthroughs in nanoscale science and engineering appear frequently to be transferred to industrial application with the active participation of discovering academic scientists. The need for top scientists' involvement provided important appropriability for biotechnology inventions, and a similar process appears to have started in nanotechnology.Lynne G. Zucker, Michael R. Darby. Movement of Star Scientists and Engineers and High-Tech Firm Entry NBER Working Paper No. 12172, April 2006.

This paper extends the concept of star scientist to all areas of science and technology. We follow careers 1981-2004 for 5,401 stars as identified in ISIHighlyCited.com, using their publication history to locate them each year. The number of stars in a U.S. region or in one of the top-25 science and technology countries generally has a consistently significant and quantitatively large positive effect on the probability of firm entry in the same area of science and technology. Other measures of academic knowledge stocks have weaker and less consistent effects. Thus the stars themselves rather than their potentially disembodied discoveries play a key role in the formation or transformation of high-tech industries. We identify separate economic geography effects in poisson regressions for the 179 BEA-defined U.S. regions, but not for the 25 countries analysis. Stars become more concentrated over time, moving from areas with relatively few peers to those with many in their discipline. A special counter-flow operating on the U.S. versus the other 24 countries is the tendency of foreign-born American stars to return to their homeland when it develops sufficient strength in their area of science and technology. In contrast high impact articles and university articles and patents all tend to diffuse, becoming more equally distributed over time.Lynne G. Zucker, Michael R. Darby, Jonathan Furner, Robert C. Liu, Hongyan Ma. Minerva Unbound: Knowledge Stocks, Knowledge Flows and New Knowledge Production NBER Working Paper No. 12669, November 2006.

The rate of regional growth of new knowledge in the field of nanotechnology, as measured by counts of articles and patents in the open-access digital library NanoBank, is shown to be positively affected both by the size of existing regional stocks of recorded knowledge in all scientific fields, and the extent to which tacit knowledge in all fields flows between institutions of different organizational types. The level of federal funding has a large, robust impact on both publication and patenting. The data provide further support for the cumulative advantage model of knowledge production, and for ongoing efforts to institutionalize channels through which cross-organizational collaboration may be achieved.Lynne G. Zucker, Michael R. Darby. Innovation, Competition and Welfare-Enhancing Monopoly NBER Working Paper No. 12094, March 2006

The basic competitive model with freely available technology is suited for static industries but misleading as applied to major innovative economies for which development of new technologies equals in magnitude around 10% of gross domestic investment. We distinguish free generic technology from proprietary technologies resulting from risky investment with uncertain outcome. The totality of possible outcomes drives the national innovation system and the returns to a particular successful technology cannot be compared to its own direct investment costs. Eureka moments are hardly ever self-enabling and incentives are required to motivate investment attempting to turn them into an innovation. The alternative to a valuable proprietary innovation is not the same innovation freely available but the unchanged generic technology. Growth is concentrated in any country at any time in a few firms in a few industries that are achieving metamorphic technological progress as a result of breakthrough innovations.So long as the entry and exit of firms using the generic technology sets the price in an industry, one or more price-taking firms can coexist with proprietary technologies yielding more or less substantial quasi-rents to the sunk development costs. Consumer welfare is increased if an innovator creates a proprietary technology such that the market equilibrium price is reduced and output increased. If the technological breakthrough is sufficiently large for the innovator to drive all generic producers out of the industry and increase output as a wealth-maximizing monopolist, consumer welfare is surely increased. After some time, the innovative technology will diffuse into an imitative generic technology. The best innovators develop a stream of innovations so that technological leaders can maintain their status as dominant firm or monopolist for extended periods of time despite lagged diffusion, and consumers benefit from this stream as well. The economics of an innovative nation are different from those of the no-growth stationary state which we teach and fall back on. We propose an ambitious agenda to integrate major research streams treating innovation as an object of economic analysis into our standard models.